Market Forecast 2023: Opportunity Amid Uncertainty

Embracing the silver lining in a bear market

December brought no end to the hand-wringing of market doomsayers. The Dow Jones Industrial Average (DJI) plunged by 2.3% (764.13 points) in mid-December to end at 33,202.22 points. This marked the sharpest decline in the Dow since September when blue chips fell by more than 1,200 points

At the same time, the S&P 500 declined by 2.5% (99.57 points), closing at 3,895.75 points, while the tech-heavy NASDAQ fell by 3.2% (360.36 points) to end at 10,810.53 points. Predicting a recession is a fool’s errand, although the climate certainly appears to be pointing in that direction.

Economists are notoriously bad at recession prophecy. You may have heard the old saw: if you put three economists in the same room, you’ll come out with four different market forecasts. The inverted yield curve is perhaps the best indicator that we’re moving toward an economic trough in 2023.

Inverted Yield Curve = Hard Times Ahead?

In a healthy market, shorter-term government bonds have a higher yield than long-term ones. An inverted yield curve does the opposite: yields on longer-term bonds increase while shorter-term bonds decrease as investors park their money in what they perceive to be safer long-term fixed income assets. While an inverted yield curve does not itself cause a recession, we believe it is the best indicator of the likelihood of one. In short, an economic downturn is likely on the horizon next year.

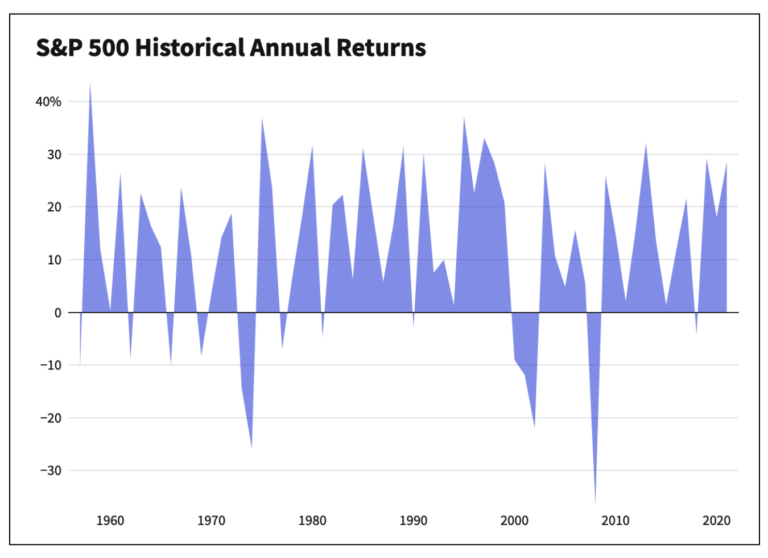

But all is not gloomy, especially when you look at the fundamentals of the American economy. As Alex Johnson from 1st and Main Investments explains: “Diversification is key to thriving during a recession. We still recommend that investors put some of their money in a low-cost index fund because when you examine its historical trajectory, it has only gone in one direction — up.”

Indeed. If you had invested $10,000 in a low-cost index fund pegged to the S&P in 1993, you’d have $170,000 today. Even with a cumulative rate of inflation of roughly 106%, you’d still be up 850% over a thirty-year period.

As this article will argue, looking for opportunities in a bear market is what savvy investors do. As the legendary investor Peter Lynch put it, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Downward market corrections will happen and building your portfolio during these corrections, especially after more than a decade of sustained growth, requires intelligence, bravery, and a bit of verve.

Now is the Time to Invest in Bonds

Coming out of the 2020 recession that never happened, market optimism was high. That enthusiasm quickly waned at the beginning of 2022 as inflation spiked. Markets across the globe have taken time to adjust to the most rapid rise in interest rates since 1982, but this whiplash reversal has opened up opportunities for investors.

We anticipate that bond markets in particular will experience a rebound in 2023. Debt securities in 2022 were an anomaly. Since 1977, the bond market has gone negative on only five separate occasions. Bonds have plunged by nearly 15% since January 2021 but seemed poised for a comeback in 2023.

While it’s hard to claim that any asset class has reached its floor, we believe that patient investors with an eye toward historical data will see the benefit of investing in bond markets in the coming year.

The energy sector should remain high

In 2022 oil and gas markets had a banner year. Unlike the rest of the economy, the energy market soared by roughly 60% across the board. It was one of eleven sectors to end the year up. With supply tight from years of low production and demand exceeding expectations by late 2021, investment in energy looks good now and into the near future.

Tight markets for energy grew even more due to Russia’s war in Ukraine and further constraints on supply. Looking ahead to 2023, we believe that the headwinds of rate hikes and a possible recession should not discourage investment in energy. Low supply and high demand should continue to drive corporate balance sheets and stock performance in oil, gas, refining, and energy services.

A severe recession or another global pandemic could adversely impact energy equities, but most economies are still recovering from the last pandemic. And while oil and gas companies have ramped up production to meet higher demand, supply will take some time to catch up.

Of course, no sector is immune to macroeconomic pressures. Anything that reduces mobility will hurt the energy sector. Regardless, developing markets and post-pandemic demand should continue to make energy, from production to refinement, a strong sector for investment in the coming years.

Don’t sleep on tech stocks

While eye-catching headlines about layoffs at Meta and Twitter have dominated news cycles, we think that there are opportunities in the technology sector despite the tech-heavy NASDAQ’s poor performance of late. With The Economist begging the question of “Who Will Survive the Fintech Bloodbath?” and M&A for fintech declining by 30% in Q2 of 2022, it is clear that many tech startups faced a bumpy road in 2022.

With VC dollars possibly fleeing tech, we understand that you may be dubious about investing in technology companies in 2023. But technology has always been a sector where Joseph Schumpeter’s idea of “creative destruction” has held the most currency. Less risk-averse investors should not shy away from the technology sector. Downside risk is a perennial problem in tech. Despite this, keep your eye out for startup companies in healthcare and insurance technologies.

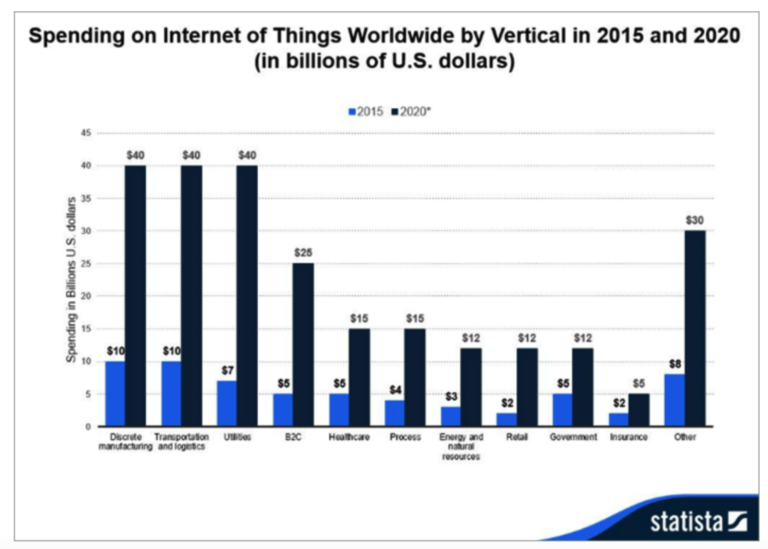

We believe that the biggest growth sector in technology will be industrial tech and the continued embrace of the Industrial Internet of Things (IIoT). As industrial firms look to streamline operations and automate their production processes, they will need the network architecture and cloud computing capabilities to accomplish this goal.

As Alex Johnson points out, “For smart manufacturers, it no longer suffices to manage physical assets manually when this work can be done by computers. Saving time and money by automating processes is as old as industrial production itself. The mind reels to think what Henry Ford would have done with the AI cloud-based machine and process management solutions we have today.” Private companies should attract even more attention from larger corporations interested in acquiring IoT innovators across numerous industry verticals.

Don’t borrow trouble

This is less specific investment advice than encouragement to take a more optimistic view of the market in 2023. The Fed has raised rates eleven times in an effort to curb inflation throughout its history. On seven occasions, these hikes resulted in a moderate to no recession.

In the late 1970s and early 1980s, Paul Volcker’s Fed wasn’t even attempting to avoid a recession. The assumption at the time was that inflation had been ignored for too long (since the Johnson administration) for any solution but the tough medicine of double-digit unemployment. In 2007, the Fed raised rates to combat inflation in the housing sector. Needless to say, rate hikes did not cause the Great Recession.

Jerome Powell’s Fed has indicated that it will look to raise the Federal Fund Rate to 5.1% next year before pausing to assess the impact on employment numbers. There is no way to guarantee a soft landing. The tools at the Fed’s disposal are crude instruments — hammers instead of chisels.

At the same time, one of the things the Fed has gotten much better at in recent decades is transparency. Pricing in rate hikes helps investors adjust their expectations. While it would be Pollyannish to expect a return of 1994, where rate hikes led to unexpected growth in the American economy, we don’t think a severe recession is a likely outcome of rate hikes in our current context.

Given the history of the impact of rate hikes on the economy, it would be premature to dismiss a soft landing as a plausible outcome in 2023. Our worst-case scenario forecasts a mild to moderate recession to combat inflation before the Fed once again begins to gradually lower the fund rate in the second half of next year.